Okay, so retirement planning tips that financial experts swear by? Yeah, I’ve been trying to actually listen to them lately because honestly, I was kinda screwing it up big time until recently. Like, picture this: I’m sitting here in my cramped apartment in the US – it’s mid-January 2026 right now, snowing outside my window in this random midwestern-ish spot I ended up in after moving for a job that paid just enough to keep me broke – and I’m staring at my phone banking app wondering how I let my savings dip so low last year on dumb stuff like takeout and that one “limited edition” gaming console I swore I’d resell. Anyway, seriously, these retirement planning tips from the pros have been game-changers even for a flawed mess like me.

Why Retirement Planning Tips Actually Matter (Even If You’re Already Behind)

Look, I used to think retirement planning tips were for old people or those finance bros on YouTube. Wrong. I hit 40-something feeling like I’d never catch up after blowing through my early 20s on ramen and bad decisions. Experts keep saying start early, compound interest blah blah – but when you’re already late, it’s about maxing what you can now. According to places like Investopedia, figuring out income sources, expenses, and smart accounts is key. I finally ran the numbers (using one of those free calculators, don’t judge) and yeah, it’s scary but motivating.

I maxed my 401(k) match last year after ignoring it forever – free money, dude! Financial experts swear by grabbing that employer match first. Seriously, if your job offers it, not contributing enough is like leaving cash on the table. I felt so stupid when I realized I’d left thousands on the table over the years.

The power of time and compound growth: If you save an amount every …

Classic compound growth illustration: the longer the runway, the crazier the end result, but starting whenever you wake up still compounds powerfully from here.

Gen X Waited To Save For Retirement: 5 Ways They’re Making Up for …

Max Out Those 2026 Contribution Limits – The Ones Experts Keep Yelling About

Okay, 2026 retirement planning tips include bumping up contributions because the limits jumped. 401(k) is up to $24,500 employee contribution, plus catch-up if you’re 50+ (and super catch-up for 60-63 folks). Roth IRA limit hit $7,500. I just increased my auto-debit – set it and forget it, like the pros say.

One expert tip I love from Fidelity and Kiplinger? Automate everything. I set mine to bump 1% every raise. Feels painless. Also, Roth conversions during dips – I did a small one last market wobble, paid some tax now for tax-free later. Tax diversification is huge, they say.

Diversify and Rebalance – Stop Being Lazy Like I Was

I had everything in company stock once. Dumb. Experts from NerdWallet and Investopedia hammer diversification – mix stocks, bonds, maybe some international. Rebalance yearly. I finally did mine last month; sold some winners, bought undervalued stuff. Felt grown-up, weirdly.

And don’t forget healthcare. Long-term care planning? Ignored it forever. Now I’m looking at HSAs – triple tax advantage, invest it like retirement money.

The Dumb Retirement Planning Mistakes I Made (So You Don’t Have To)

Alright, raw honesty time. Common retirement planning mistakes Americans make? I did most.

- Claiming Social Security too early – not yet, but I was tempted at 62 for quick cash. Experts say delay for bigger checks.

- Underestimating expenses – thought I’d live cheap. Nope, healthcare, inflation, random home repairs.

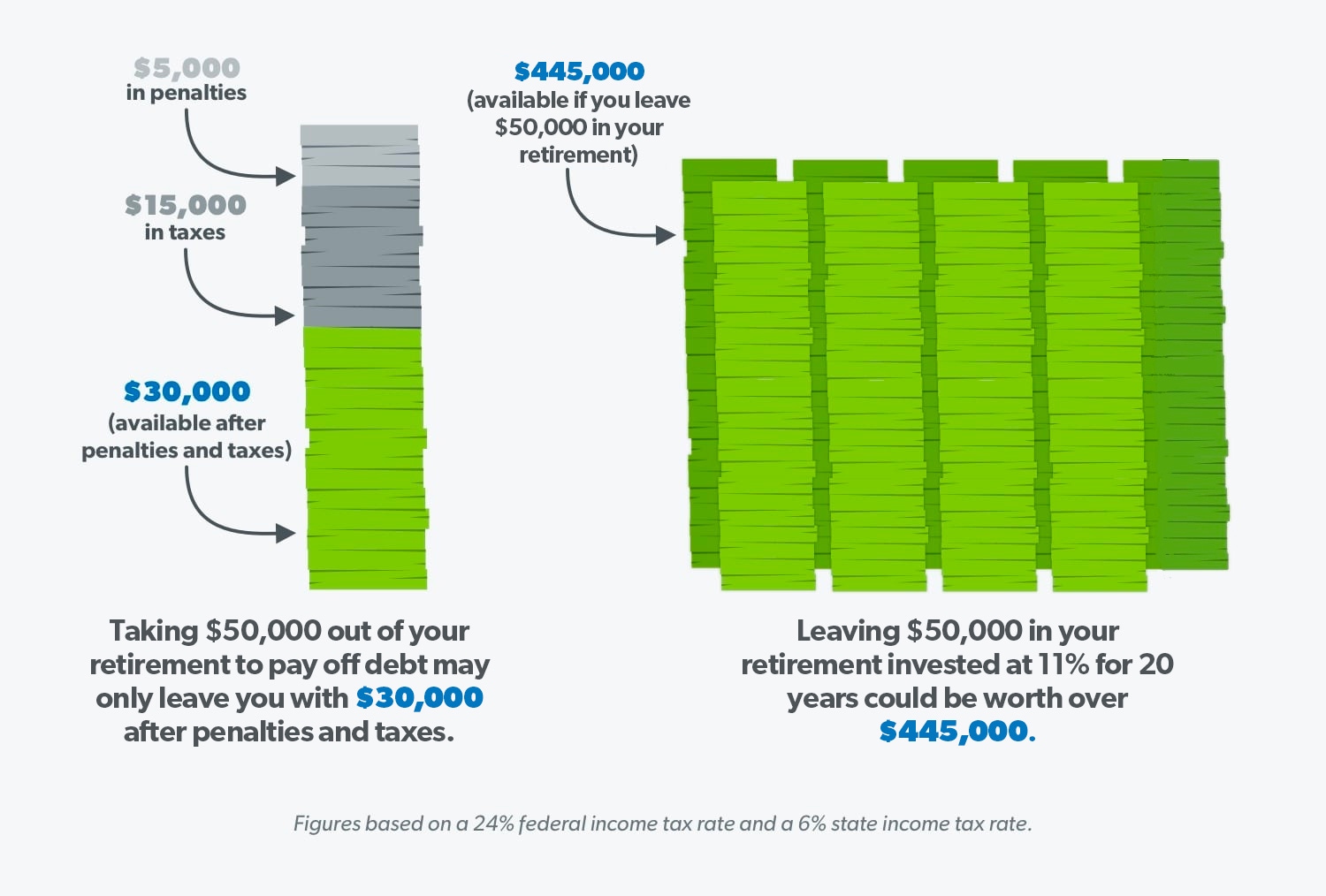

- No emergency fund – had to dip into retirement once. Never again.

- Ignoring taxes on withdrawals – traditional IRA hits hard in retirement.

- No estate plan – beneficiaries outdated. Super embarrassing if something happens.

Check out Kiplinger’s list of regrets or Investopedia on mistakes – eye-opening.

These images highlight real retiree confessions and financial traps (like early withdrawals, tax hits on

Roth Strategies and Catch-Ups – What Saved My Ass

Roth conversions during low markets? Did a bit, smoothed taxes. Catch-ups if over 50 – extra $1,100 on Roth IRA this year. Automate, max ’em. Fidelity pushes reevaluating itemizing too with tax changes.