Analyze the Stock Market I’m sitting here in my messy home office outside DC, January 2026, it’s like 28°F outside, the radiator is making that weird death-rattle again, and my third coffee today tastes like regret. And yeah—I still suck at analyzing the stock market sometimes. Like, spectacularly. But after blowing up two small accounts in 2022–23 (one because I YOLO’d calls on a meme stock the night before earnings, the other because I averaged down on a “can’t possibly go lower” Chinese EV name until it literally became worth less than my weekly DoorDash bill), I’ve finally cobbled together something that feels… semi-pro. Or at least less clown-like.

So here’s my current, flawed, very American, please-don’t-sue-me way to actually analyze the stock market like a pro (or at least fake it convincingly).

Why Most “How to Analyze Stocks” Guides Feel Like BS to Me

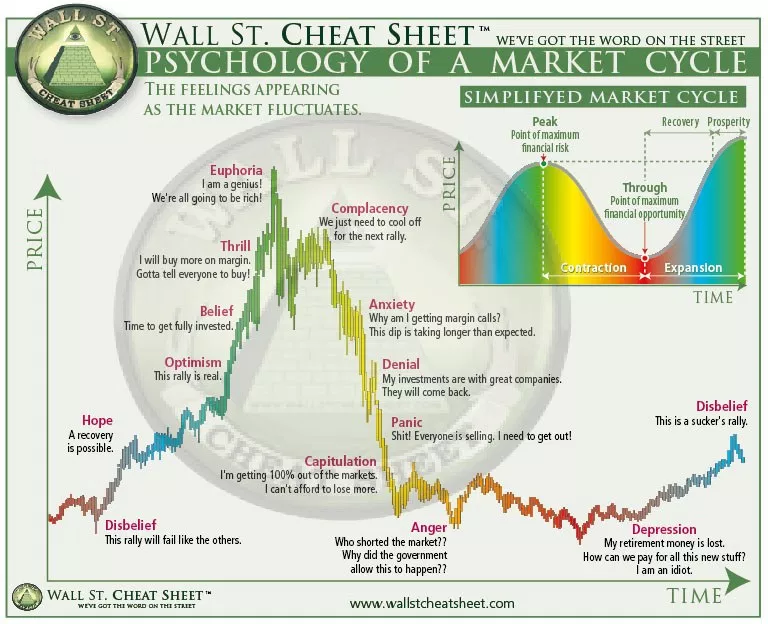

Everyone online wants to sell you the clean version: Analyze the Stock Market “Just use these three indicators + this fancy scanner + mindset = lambo.” Meanwhile I’m over here refreshing my brokerage app at 2 a.m. wondering why my soul hurts. The truth is pro-level stock market analysis is 40% math, 40% psychology, and 20% accepting that the market is mostly a chaotic casino run by slightly smarter gambling addicts than you.

François Sicart – Sicart

First thing I had to accept: there is no perfect system. Even the quants at Citadel get it wrong. A lot.

Step 1: I Force Myself to Do Fundamental Analysis (Even Though It Bores Me to Tears)

I used to skip this part entirely. Big mistake.

Now, before I even look at a chart, I make myself answer these stupidly basic questions (usually while the dog is aggressively licking my ankle):

- Does this company actually make money? (Check latest 10-K / earnings report)

- Are revenues growing or shrinking—and why?

- What’s the debt look like? (I got wrecked by high-debt names in 2022 when rates spiked)

- Is the CEO saying crazy things on earnings calls lately?

Quick resources I actually use almost every time:

- SEC EDGAR for raw filings → https://www.sec.gov/edgar

- Yahoo Finance or Finviz for quick snapshot → https://finance.yahoo.com

- Koyfin (underrated, clean dashboard) → https://www.koyfin.com

If the fundamentals are garbage, I usually don’t bother with the chart. Life’s too short.

Step 2: Technical Analysis That Doesn’t Make Me Want to Die

Okay this is where I still argue with myself daily.

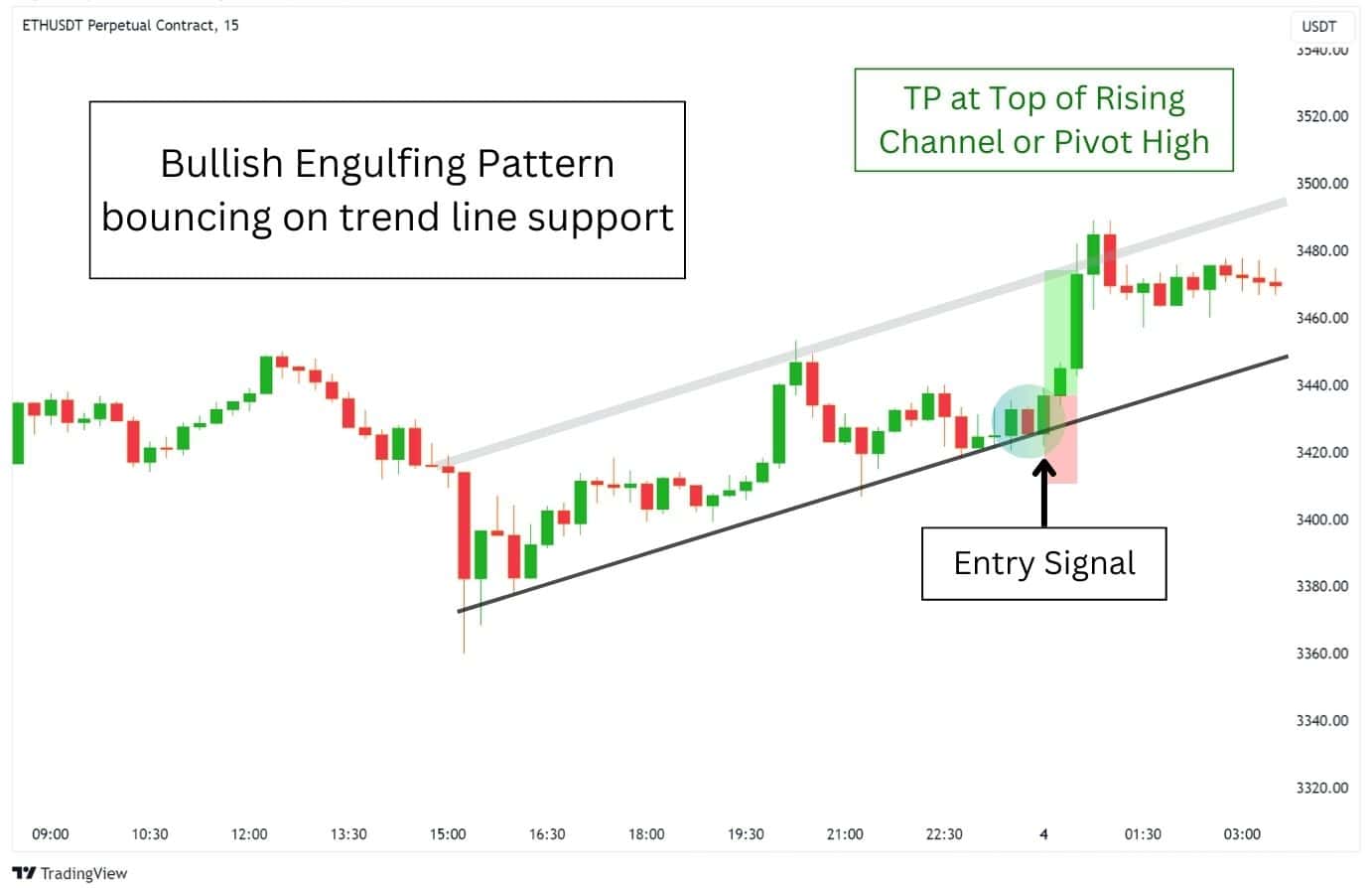

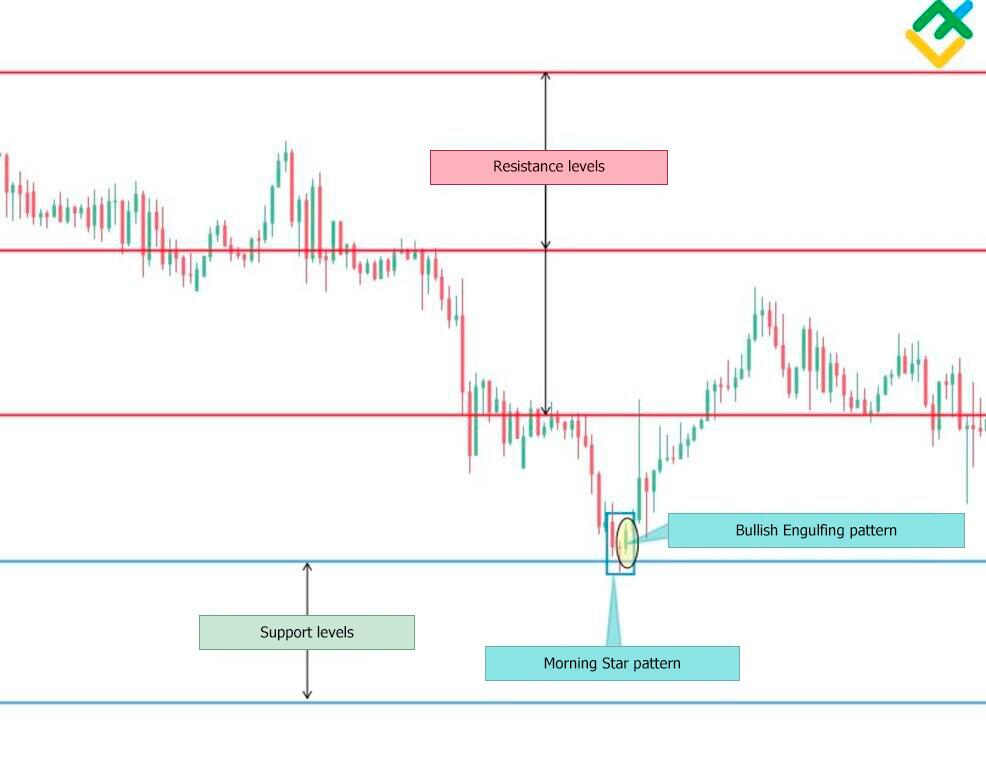

I no longer try to be a pure price-action ninja or a 47-indicator Frankenstein. Instead my current (very imperfect) setup is:

- Daily + 4-hour timeframe (I day-trade too much on 5-min and it’s bad for my blood pressure)

- 50 & 200 SMA (cliché but they still matter)

- Volume profile or at least watching where big volume nodes are

- RSI (only 14-period, and I mostly use it to spot extreme readings >75 or <25)

- One single candlestick pattern I trust: the “sorry mommy” engulfing bar at key levels (I named it that after I got faked out for the 400th time)

Pro tip I learned the hard way: Analyze the Stock Market if you’re staring at a chart for more than 7 minutes without knowing what you’re looking for → close the tab. Seriously. Save your retinas.

And finally, a little humor for the over-analysis warning — staring at a chart for 7+ minutes with no plan is basically asking for pain (and fried retinas):

Step 3: The Part Nobody Talks About – My Emotional Dashboard

This is the embarrassing bit.

I now keep a literal Google Sheet titled “Why Am I About to Ruin My Life Again?” with columns:

- Feeling right now (FOMO / Revenge / Hopeless / God Mode)

- Caffeine units consumed today

- Hours slept

- Did I just fight with my partner?

- Did I see a TikTok “millionaire trader” reel in the last 30 min?

If more than two are red… I’m not allowed to place a trade. Sounds dumb. Saved me probably $8,000 last year alone.

Also I journal every single trade now. Not in some cute notebook—straight in Notion with screenshots. Reading back the entries from 2023 is like watching a slow-motion car crash narrated by an idiot.

Quick Checklist I Actually Run Before Almost Every Trade in 2026

- Fundamentals pass (or at least aren’t horrifying)?

- Price near a high-probability level (previous high volume node, 200 SMA, weekly pivot)?

- Higher timeframe agrees?

- My emotional dashboard isn’t screaming “abort”?

- Position size < 2% of account (I used to do 15–20%. Bad idea.)

- Do I know exactly where I’m wrong (stop-loss) and where I’ll take partials?

If I can’t answer yes to at least five… I walk away. Usually to go pet the dog and stare at the wall for ten minutes.

Final Messy Thoughts (Conclusion)

Look—I’m still not a pro. I still revenge-trade sometimes. I still get FOMO when everything’s ripping and I’m in cash. I still drink too much coffee and yell at candlesticks like they can hear me.

But I lose less often now. And when I lose, the losses are smaller and I don’t spiral for three days afterward.