Beginner investing 2026 is honestly terrifying and kind of exciting at the same time and right now I’m sitting here in my tiny living room in the US with half a cold coffee, three browser tabs open to different brokerage sign-up pages, and a notification from my bank saying “low balance” like it’s personally judging me.

Seriously.

Last month I finally put my first $300 into a real brokerage account after talking about it for literally two years. Felt like jumping off a diving board into a pool I wasn’t sure had water.

Why 2026 Feels Different for Beginner Investing

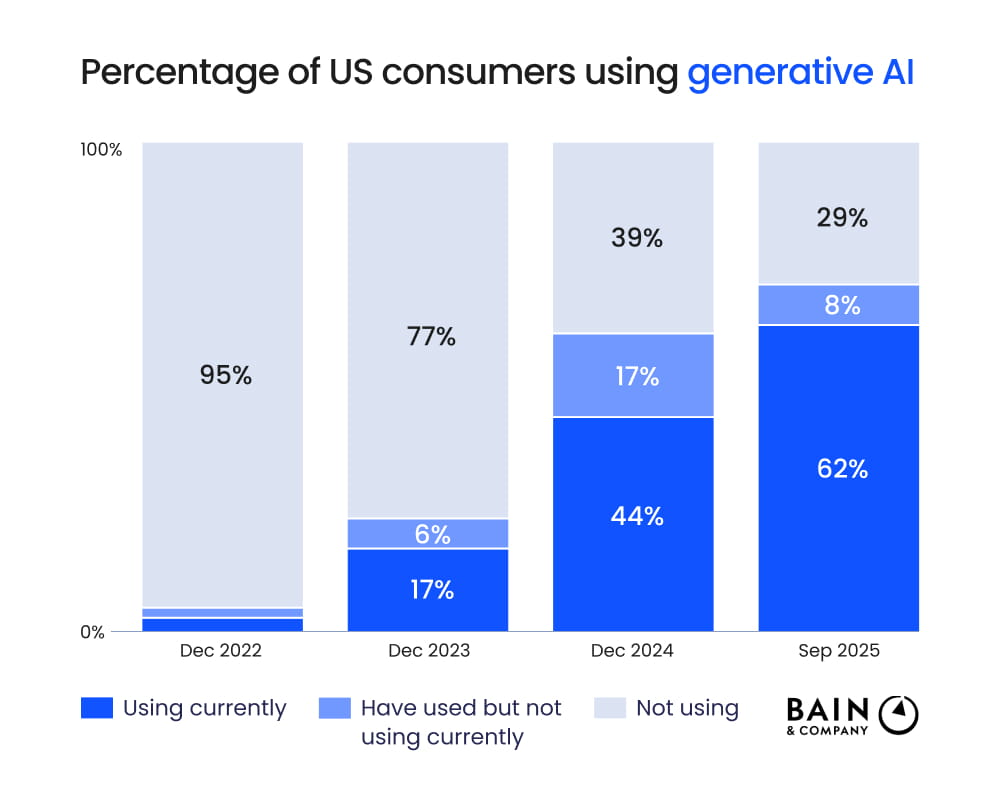

The vibe is… weird? Rates are still kinda high-ish, AI stocks are doing whatever they want, crypto is having another moment, and every YouTuber is screaming about “the next 10x opportunity”.

Meanwhile I’m over here trying to understand what an expense ratio even is without wanting to cry.

Some quick context I found helpful (and you should definitely read these):

- Vanguard’s beginner investing overview – boring but gold

- SEC Investor.gov – literally the government trying to save us from ourselves

- Bogleheads wiki – the cult I’m slowly joining

My First Three Investing Mistakes (So You Don’t Have To)

- I panic-bought one single “hot” stock because my cousin texted me “this is gonna moon bro” → lost 38% in three weeks. Still hurts to look at the app.

- I signed up for like four different apps in one weekend (Robinhood, Webull, Fidelity, SoFi) and then got overwhelmed and did nothing for a month.

- Thought “diversification” meant buying five different meme stocks. Spoiler: it does not.

Anyway.

If I could slap past-me, I’d say: start boring. Like aggressively boring.

What I Actually Did (and What I’m Doing Now in 2026)

I eventually went super basic and I’m actually sleeping better because of it.

Here’s my current ultra-lazy-but-kinda-smart setup in January 2026:

- 70% → VTI (total US stock market ETF)

- 20% → VXUS (international stocks)

- 10% → just cash sitting in a high-yield savings account at like 4.3% because I’m still scared

I’m using Fidelity because their app doesn’t make me feel like I’m gambling even though sometimes I still feel like I’m gambling.

Also started a Roth IRA this year (2026 contribution limit is $7,500 if you’re under 50 – check IRS.gov because it changes). That felt very adult. I cried a little when I hit submit. Not even embarrassed.

Tools & Apps That Don’t Make Me Want to Throw My Phone (2026 Edition)

- Fidelity – clean, free trades, great research

- Vanguard – if you like pain and low fees

- M1 Finance – literally sets it and forgets it (pie investing)

- Acorns – still good if you’re starting with literally $5

- Yahoo Finance or TradingView for charts when you inevitably get addicted to looking at red and green candles at 2 a.m.

Quick Reality Check Before You YOLO Your Rent Money

Investing for beginners in 2026 still follows the same old rules:

- Only invest money you won’t need for at least 5–7 years

- The market will drop 20–30% again. It always does.

- Time in the market > timing the market (I hate this phrase but it’s annoyingly true)

- You will feel stupid sometimes. That’s normal.

I still check my account way too often and feel euphoric when it’s up 1.4% and suicidal when it’s down 0.8%. Human.

Wrapping This Chaotic Mess Up

Look… beginner investing 2026 isn’t about getting rich tomorrow.

It’s about starting, screwing up a little (or a lot), learning, and then continuing anyway.

I’m literally still figuring it out. My portfolio is tiny. My knowledge has more holes than Swiss cheese. But I’m in the game now instead of just watching from the sidelines.