How to build a budget that actually works for you is something I genuinely thought was impossible until like… last year? I’m sitting here in my apartment outside DC, January 2026, heat blasting because it’s 28°F outside, staring at my Chase app that’s still judging me for that $12 oat milk latte on January 2nd. True story.

I used to think budgeting meant downloading some scary app, linking every account, and then immediately feeling like a failure when it screamed YOU SPENT 238% OF YOUR FUN MONEY ON UBER EATS. Spoiler: that method never worked. Not once.

Why Most Budgets Feel Like They’re Judging You

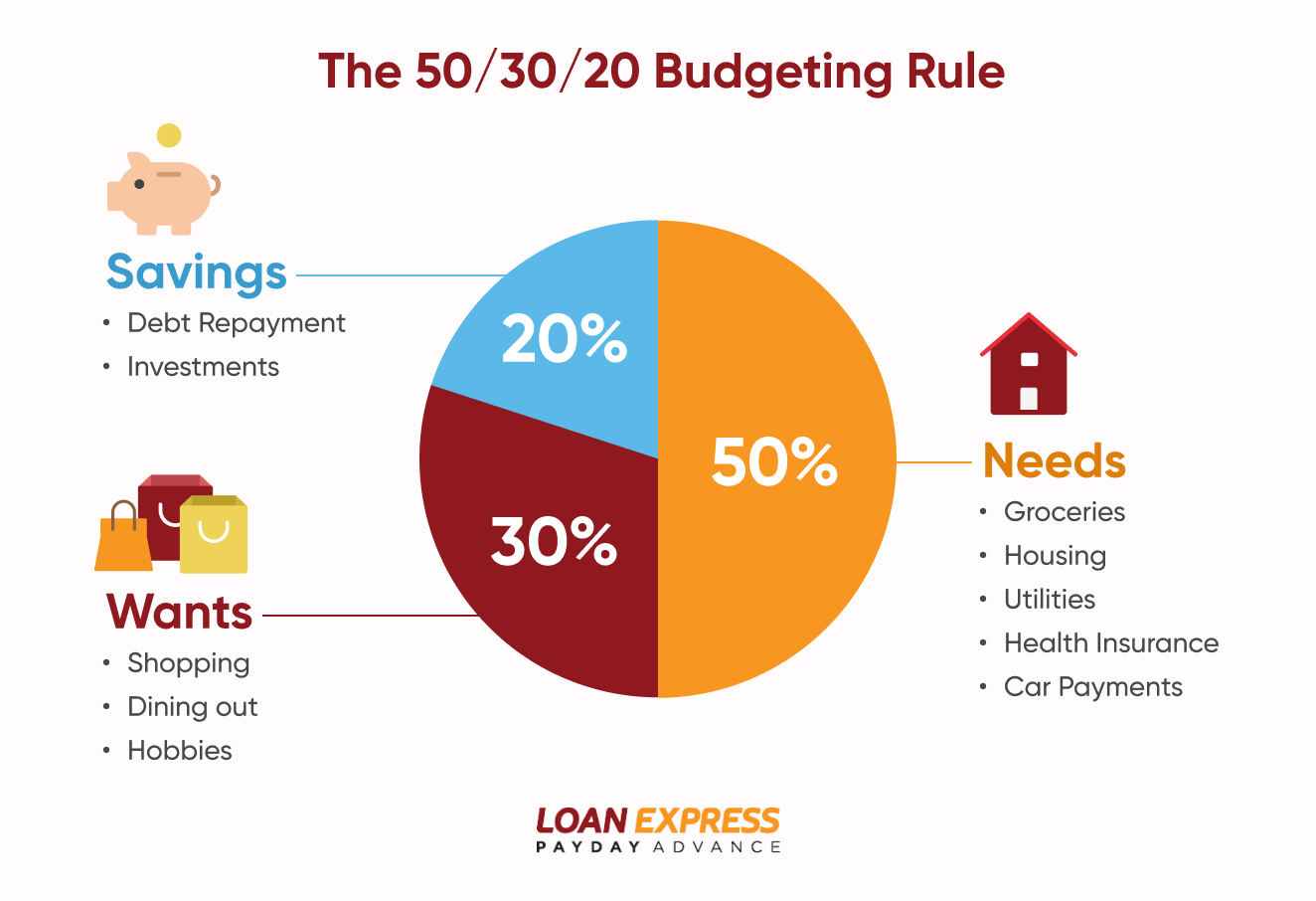

How to Build a Budget I tried the classic 50/30/20 thing everyone on YouTube swears by. You know — 50% needs, 30% wants, 20% savings/debt. Sounds smart. Except my “wants” somehow included DoorDash, new running shoes I wore twice, and three different streaming subscriptions I forgot to cancel. The math never added up because my life isn’t math. My life is chaos with good intentions.

Here’s what finally clicked after approximately seventeen failed budget attempts:

Master the 50/30/20 Budgeting Rule | Loan Express

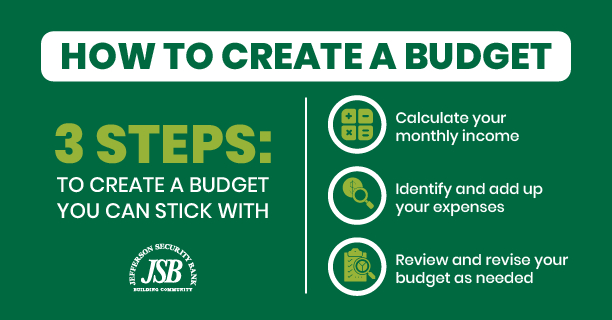

Step 1: Start Stupidly Simple (Like Embarrassingly Simple)

Forget apps for the first two weeks. Seriously. I grabbed a literal legal pad from Staples, drew three columns with a dying blue pen:

- Money In

- Money Out (必需品 = rent, phone, groceries, gas)

- Money Out (everything else that makes me feel briefly alive)

That was it. No fancy categories. No sub-sub-sub categories. Just ugly handwriting and coffee rings. And weirdly… seeing it on paper made the bleeding obvious. I was spending $180/month on “miscellaneous food” which was code for “I’m too tired to cook so I DoorDash again.”

Check out the envelope method basics from Ramsey Solutions if you want the OG paper version inspiration → https://www.ramseysolutions.com/budgeting/envelope-system-explained

Step 2: Give Every Dollar a Job… But Make the Jobs Realistic

Zero-based budgeting sounds intense but the core idea saved me: How to Build a Budget every dollar gets assigned before you spend it. Except I gave some dollars very dumb jobs at first.

Example from my January 2025 disaster budget:

- $60 → “eating out” (lol I blew it in 9 days)

- $0 → “savings” (whoops)

- $45 → “random Amazon impulse buys” (new category born mid-month)

Now I do:

- $120 → “fun food & coffee” (increased it because lying to myself was worse)

- $200 → “extra debt snowball”

- $50 → “no-questions-asked fun” (this saved my sanity)

The trick? Make one category bigger than feels responsible. I’d rather budget $130 for takeout and actually stick to it than pretend I’ll survive on $60 and then hate my life.

YNAB (You Need A Budget) explains the philosophy really well even if you never buy the app → https://www.ynab.com/the-four-rules

Step 3: Track Like You’re Slightly Paranoid (But Not Crazy)

I use my Notes app now. Every single purchase goes in immediately. “$8.47 Starbucks — oat milk latte + cake pop because meetings suck” “$4.99 Spotify — still paying for family plan even though no one else uses it smh”

It takes 8 seconds. And after 30 days the guilt turns into data. Data feels less personal than shame.

Pro tip I learned the hard way: set one text alert for every purchase over $30. The little buzz on my phone when I bought those $68 noise-canceling headphones at Target felt like getting caught by my mom.

Step 4: Adjust Every Damn Month (This Is the Secret)

My budget in November looks nothing like February. Thanksgiving + Christmas + “I deserve this after the holidays” January sales wrecked me last year. Now I literally open the notes on the 1st and rewrite the categories based on what actually happened last month. It’s messy. It’s imperfect. It works.

The Part Where I Still Screw Up (Because I’m Human)

Last week I impulse-bought $112 worth of houseplants during a 1 a.m. scrolling session. How to Build a Budget My budget said “house stuff – $40.” I moved money from “fun food” to cover it. And you know what? That’s fine. The budget didn’t explode. It flexed.