Okay y’all… budgeting tips. Right in the very first sentence: I’m sitting here in my messy apartment outside Philly trying to figure out how to save more money without turning into that person who never leaves the house or eats anything except plain rice.

Last Saturday I almost cried in the grocery store because the good oat milk was $6.49 and my brain screamed “you can get two iced coffees with that.” But then I remembered I’m trying to not be broke forever. So here we are.

Why Most Budgeting Advice Feels Like It’s Written by Robots

You know those articles that say “just cut out coffee and you’ll save $1,872 a year!!!!”? Yeah I tried that for exactly 11 days in 2024 and I turned into a gremlin. My hands were shaking. My coworkers asked if I was okay. I was not okay.

I’m not here to tell you to give up everything fun. Budgeting Tips I’m here to tell you how I actually save more money now while still going to see live music, eating out sometimes, and buying the occasional dumb thing I don’t need (looking at you, $22 candle that smells like “clean laundry but make it sexy”).

:quality(85):extract_cover()/2024/12/13/873/n/1922794/a1bf9a9c675c91d736c020.47174247_.jpg)

My Current Setup (It’s Not Pretty But It Works)

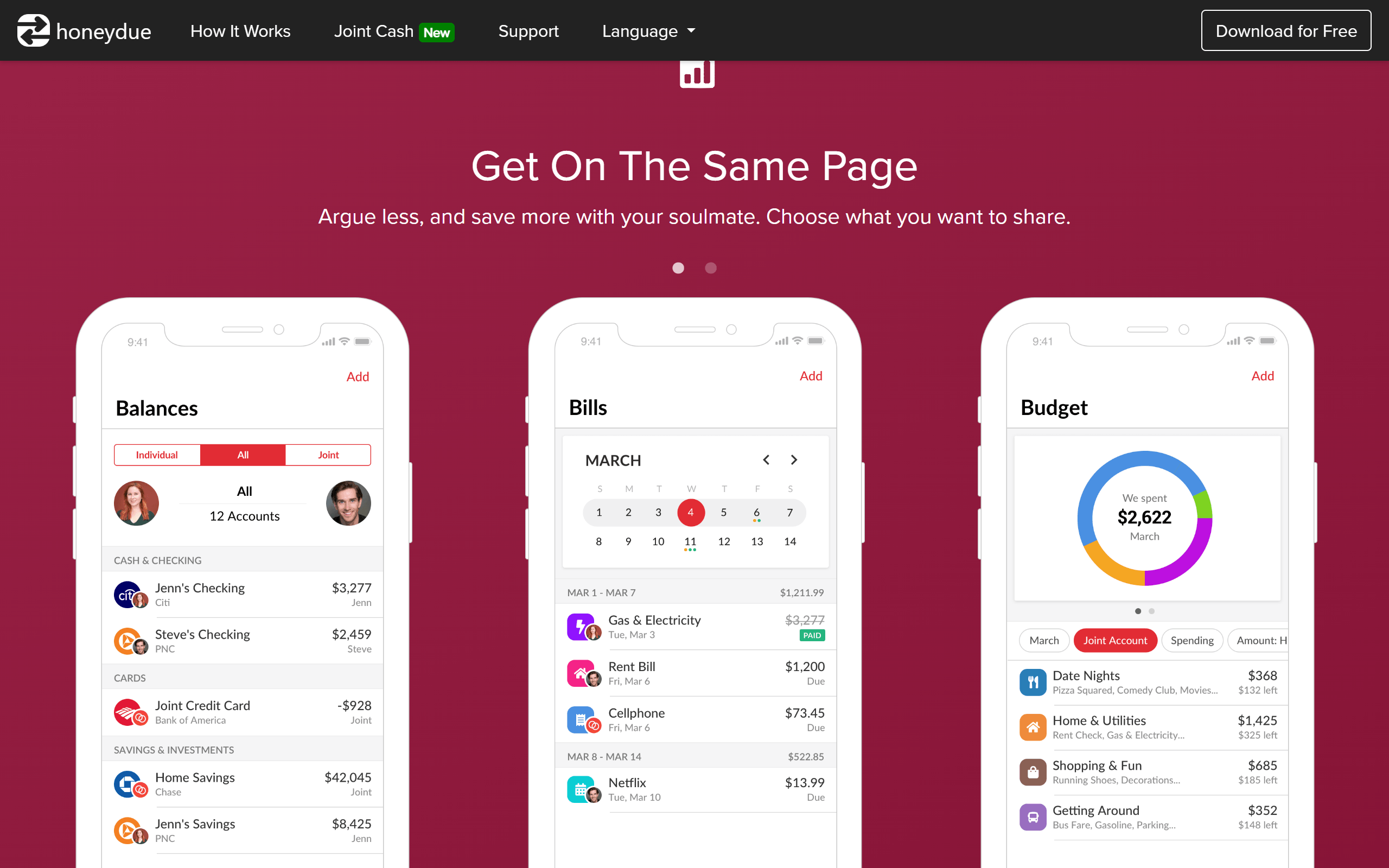

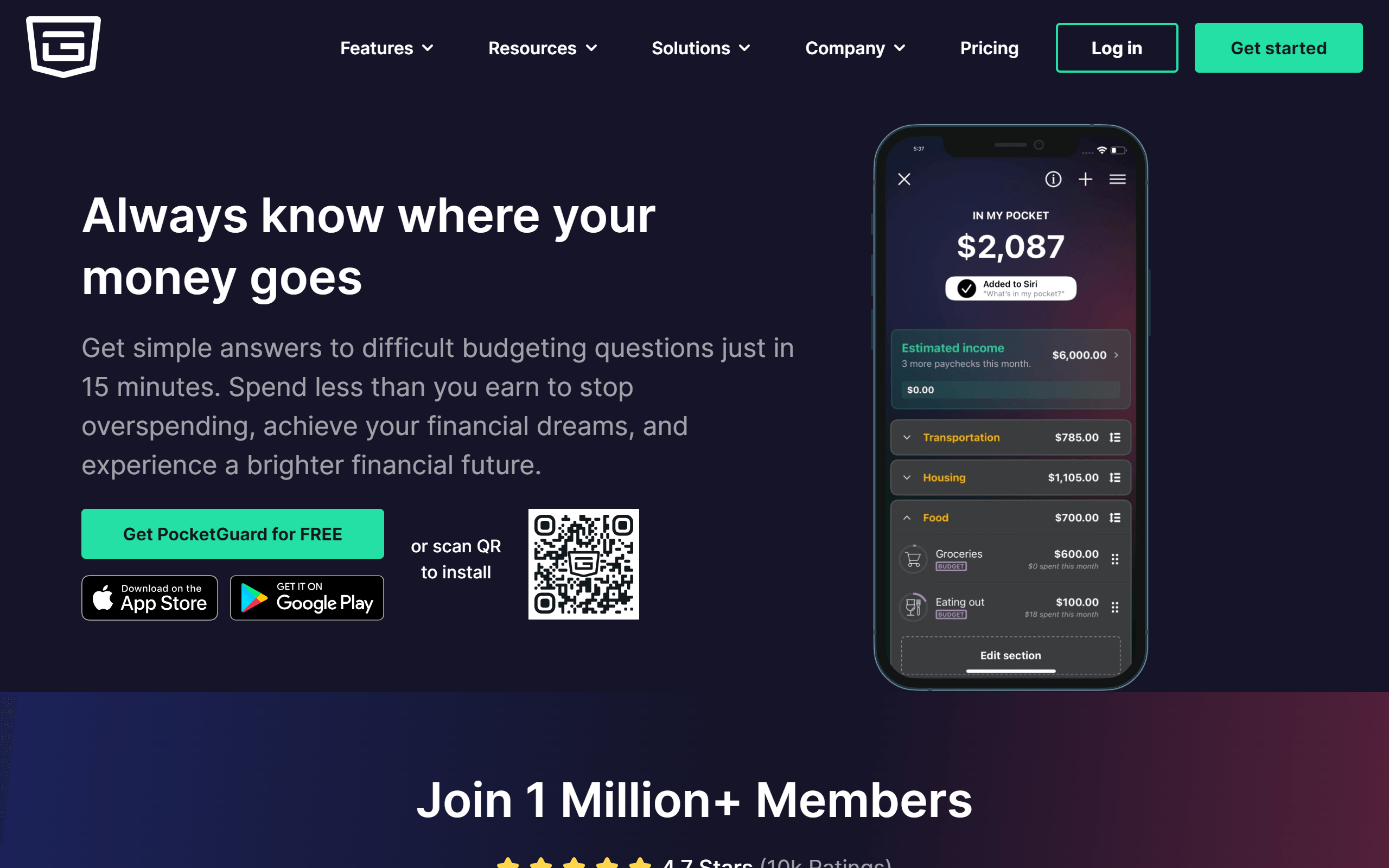

I use a stupid simple system I stole pieces of from everywhere:

- YNAB (You Need A Budget) – yeah I pay for it and yeah it hurts every year but it’s honestly the only thing that made me stop lying to myself about money → https://www.ynab.com/

- One checking account for bills + necessities

- One “fun” checking account that gets $350 deposited twice a month

- High-yield savings (I use Ally right now, 4%+ is nice in 2026) → https://www.ally.com/bank/online-savings-account/

When the fun account hits zero… that’s it. No dipping into savings for another round at the bar. It feels brutal the first few months but then it just becomes normal.

How I Trick Myself Into Saving More Money Without Hating Life

Here’s the real talk list:

- I pre-pay for fun stuff. Bought tickets to a concert in June already? Money’s gone. Brain doesn’t see it anymore. Feels free when the show comes.

- “No spend” days are actually “only spend on food and gas” days. I still get my iced matcha. I’m not a monk.

- I keep a “stupid purchase” envelope (digital in YNAB). Every dumb thing goes there. Seeing $187 spent on DoorDash, random thrift hauls and one very cursed eBay vintage hoodie makes me pause next time.

- Swap one big outing for lots of cheap ones. Instead of $120 fancy dinner I do $18 tacos + $8 margarita at the place by my house + walk home listening to a podcast. Same vibes, 75% cheaper.

- I literally gamify it. If I end the month with >$100 left in fun money I transfer $50 straight to savings and buy myself one $15-$20 treat. Last month it was new headphones. Felt earned.

Two thirds of Brits get buzz from saving money – and it doesn’t …

The Time I Totally Failed (and What I Learned)

Last August I said “screw it” and went to a music festival. Three-day pass + merch + drinks + overpriced food = $680 gone in 72 hours. My fun account was -$412 because I “borrowed” from savings. I felt sick for two weeks. Not from the hangover. From the guilt.

Now I have a “festival fund” that I put $40 into every paycheck starting six months out. If I don’t have the money when tickets go on sale… I don’t go. Harsh? Yes. But I haven’t had another -$400 panic attack since.

Final Rambling Thoughts While My Coffee Gets Cold

Look. I’m not a financial guru. Budgeting Tips I still impulse-buy plants I don’t have space for and I definitely spent $9 on a matcha latte yesterday even though I had coffee at home. But I’m saving more money than I ever have while still going to shows, eating good food, and buying small things that make me happy.

If you’re sitting there thinking “I suck at this money thing,” same. We all do at some point. Start stupid small. Move $20 a week. Track one category. Give yourself permission to still have fun.