Okay real talk — tax planning tips 2026 are living rent-free in my head right now because last April I legit almost vomited when I saw what I owed Uncle Sam. I’m sitting here in my messy home office in the US, January 2026 vibes, space heater humming like it’s about to take off, empty energy drink cans everywhere, staring at my sad bank app balance going “we gotta fix this shit.”

So here are the 7 tax planning tips everyone should follow in 2026 according to someone who learned most of them the hard (and expensive) way.

1. Max Out Retirement Accounts Early in 2026 (Seriously, Do It in January)

I used to wait until December like a dumbass thinking “eh I’ll catch up.” Spoiler: I never caught up. In 2025 the 401(k) limit is probably bumping again (check IRS site for exact 2026 numbers → https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits), but the point is — front-load that sucker.

The earlier you contribute, the more time your money has to grow tax-deferred. I started doing $1,500–$2,000 extra per month in January last year and it felt like I bought myself an extra vacation. Psychological win + actual compound interest win.

2. Bunch Your Charitable Donations Like You’re Playing Tetris

I used to give $200 here, $100 there, never hitting the standard deduction. Then some Reddit tax nerd changed my life. Bunch two or three years of donations into one tax year so you can itemize and actually get the benefit.

Donated a chunky amount to my local food bank in December 2025 and planning to skip big cash gifts in 2026 — already feeling smug about it. More info on charitable contribution rules → https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contribution-deductions

3. Harvest Those Tax Losses Before December 31 (But Don’t Be an Idiot Like Me)

7 Tax Planning Tips Tax-loss harvesting 2026 edition. I sold a couple loser ETFs in late November one year and forgot about the wash-sale rule. Bought the same damn ETF back three days later. IRS said “cute” and disallowed the loss. Lost like $1,800 in tax savings because I have the patience of a toddler.

Wait 31 days or pick a different but similar fund. Fidelity and Vanguard both have decent guides on this → https://www.fidelity.com/learning-center/personal-finance/tax-loss-harvesting

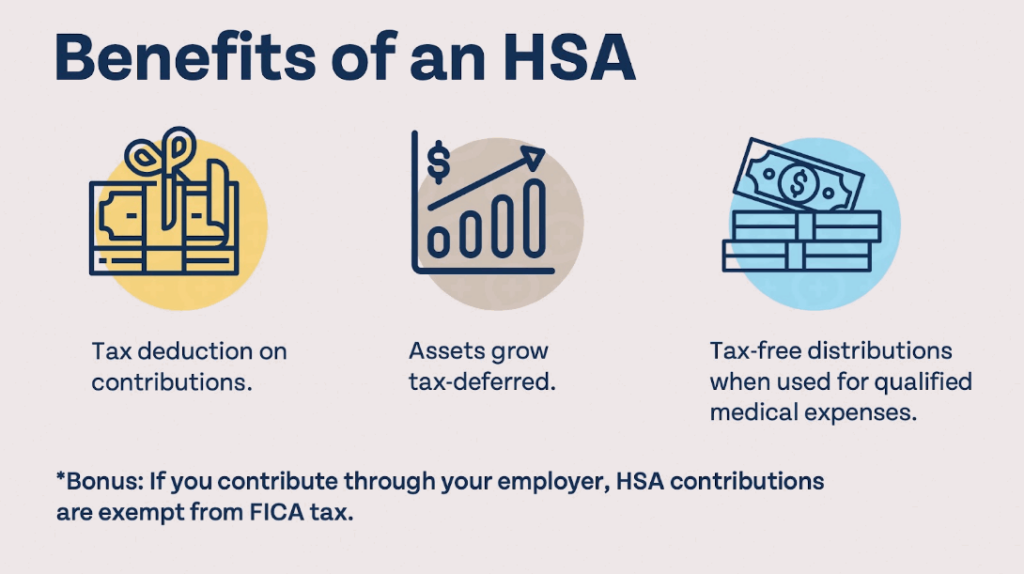

4. Open & Fund an HSA If You Have a High-Deductible Health Plan

This one still blows my mind. Triple tax advantage: contributions deductible, growth tax-free, withdrawals for medical expenses tax-free. I switched jobs in 2024, got an HDHP, ignored the HSA for six months, then panic-funded it in December. Felt like throwing money into a black hole at first, but holy crap the 2025 tax bill was noticeably smaller.

2026 HSA limits should be announced soon — track here → https://www.irs.gov/publications/p969

5. Consider a Roth Conversion Ladder If You’re In a Weird Income Dip Year

My freelance income tanked mid-2025 (thanks surprise medical thing). Tax bracket dropped hard. So I did a partial Roth conversion — paid taxes at like 12% instead of the 24% I normally would’ve. Money now grows tax-free forever.

Not for everyone. Run the math. Painful calculator here → https://www.nerdwallet.com/article/taxes/roth-ira-conversion

6. Move to Quarterly Estimated Payments So You Don’t Owe a Giant Bomb

I used to get hit with underpayment penalties every damn year. Started doing quarterly estimates in 2025 and suddenly April 15 wasn’t a horror movie. Use the IRS withholding estimator → https://www.irs.gov/individuals/tax-withholding-estimator

Pro move: overpay a tiny bit each quarter so you get a small refund instead of owing. Feels like a cheat code.

7. Actually Talk to a CPA Before December (Not February)

This is the most embarrassing one. 7 Tax Planning Tips I spent years doing my own taxes with TurboTax, thinking I was slick. Then 2024 I paid a CPA $450 and she found me $3,200 more in refunds + saved me $1,100 in future penalties. Worth every penny.

Book the appointment now while they still have January–February slots. Find someone decent here → https://www.naea.org (National Association of Enrolled Agents)

Look… I’m not a tax pro. I’m just a guy in sweatpants who cried real tears opening a tax bill once. These tax planning tips for 2026 are the exact playbook I’m running this year so I don’t repeat last year’s disaster.