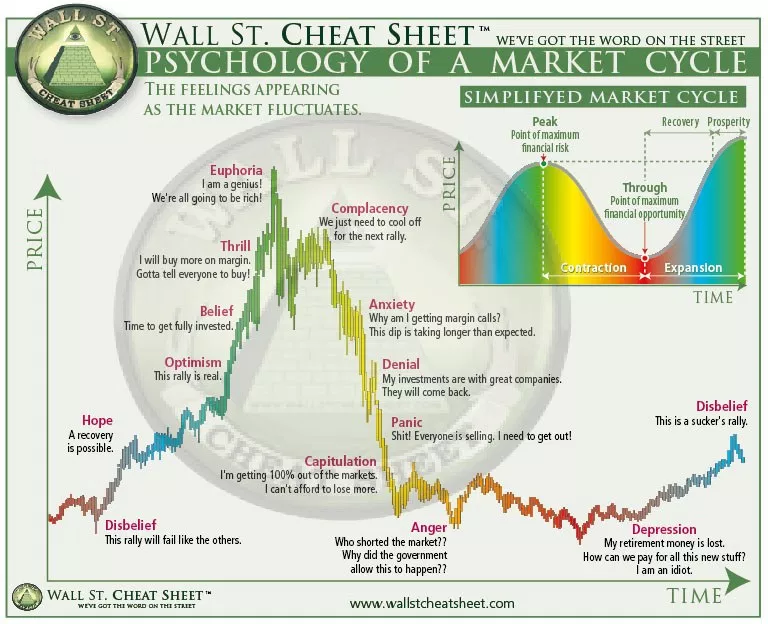

5 investment strategies experts don’t want you to know have been rattling around in my head since like last Tuesday when I was sitting in my beat-up Corolla in the Chick-fil-A drive-thru in Faridabad—no wait, scratch that, I’m in Maryland right now, January 2026, windows fogged up because the heater is trash and I’m stress-eating waffle fries while staring at my Robinhood app that’s bleeding red again.

Seriously though.

I’ve lost money. 5 Investment Strategies A lot. Like enough to make my mom cry if she knew the real number. And yet somehow, after eating enough humble pie to feed a small village, I’ve stumbled into a handful of things that actually seem to work—and that the polished financial gurus on YouTube and CNBC very rarely mention in plain English.

Here are the five that keep saving my ass (or at least slowing down how fast I set it on fire).

1. Buy the Boring Dividend Aristocrats When Everyone Else Is Panicking

I used to chase the next Tesla / Nvidia / whatever-meme-stock-is-trending-on-Reddit. Then 2022 happened and I watched 60% of my “genius” tech portfolio evaporate faster than my self-respect.

Now? When the VIX is spiking and people are panic-selling, I quietly buy shares of the most yawn-inducing Dividend Aristocrats I can find—companies that have raised dividends for 25+ consecutive years.

Examples right now (January 2026):

They’re not sexy. But when everything else is down 30%, these ugly ducklings are usually only down 10–15%… and they’re still mailing you a check every quarter while you wait for the world to stop being insane.

VIX/VVIX Spike Risk — Indicator by CIVolatility — TradingView

Then the shift to calm, boring stability — Dividend Aristocrats quietly holding up while chaos reigns:

2. The “Fuck It, I’m Early” Covered Call Wheel on Boring ETFs

Yeah I said fuck it in the subheading. Sue me.

I learned this the painful way after selling naked puts on SPY during a 2025 dip and getting absolutely torched.

Now I do the poor man’s version:

- Buy 100 shares of something stable and high-liquidity like SCHD (Schwab U.S. Dividend Equity ETF)

- Sell out-of-the-money covered calls against it

- If it gets called away → great, profit

- If not → pocket premium and repeat

It’s not get-rich-quick. It’s get-rich-gradually-while-drinking-coffee-and-not-having-heart-attacks.

3. Dollar-Cost-Average Into Bitcoin… but Only With Money You’ve Already Mentally Burned

Look. 5 Investment Strategies I’m not telling you to YOLO your 401(k).

But I’ve been putting $150–$300 a month into BTC since early 2023 using nothing but “fun money” I already assume is gone.

When it’s $25k I feel like a genius. When it’s $95k I feel like an idiot for not buying more. When it’s $48k I just shrug and keep buying because the number on the screen stopped meaning anything emotional years ago.

This isn’t an investment strategy so much as a psychological torture device that occasionally prints money.

4. The Weird Side-Hustle-to-Index-Fund Pipeline Most “Experts” Ignore

Nobody wants to talk about this because it’s not sexy.

I make extra money doing freelance copywriting (yes, I’m aware of the irony). Every dollar above $1,200/month that comes in automatically goes into VTI or VXUS—no exceptions.

No lifestyle creep. No new sneakers. Just boring broad-market ETFs.

In 2025 I funneled almost $14k of side-hustle cash into the market while everyone else was upgrading their iPhone. That $14k is now worth… well, more than $14k. Shocking, I know.

5. Buy Far-Out LEAPS Calls on Quality Companies After a 40%+ Drawdown (and Pray)

This one is the most degenerate of the bunch and I almost didn’t include it.

But it’s literally how I crawled out of the 2022 hole.

When a great company I already respect (think MSFT, GOOGL, V, etc.) drops 40%+ for macro reasons—not because they started sucking—I buy 12–24 month LEAPS calls way out of the money.

It’s basically leveraged long-term conviction with an expiration date.

I’ve been burned hard doing this (looking at you, 2022 Meta calls), but the ones that worked… holy crap.

Just don’t use rent money. Ever.

Anyway.

That’s my messy, flawed, occasionally embarrassing list of 5 investment strategies experts don’t want you to know—at least not in this unfiltered, slightly alcoholic version.

I’m still learning. I still do dumb shit sometimes. My portfolio is far from perfect.

But these five things have kept me alive (financially) longer than any slick 12-step plan ever did.

What’s the one weird investing habit you’ve found that actually works for you? Drop it below—I’m nosy and also desperate for more ideas before the next crash.

Stay safe out there. And maybe don’t check your brokerage app while eating waffle fries in a parked car. Learned that one the hard way too.